Berlin-based finmid, a startup that helps B2B platforms provide customised financing support to their small and medium-sized customers, has exited stealth mode and raised €35M in early-stage equity funding.

Concurrently, finmid has also announced a partnership with Wolt, a Helsinki-based tech company known for its local commerce platform.

finmid says it will use the funds to drive sustainable growth and product innovation, focusing on expanding into core markets, localising operations, and enhancing financing options for “easier” platform integration and improved user experience.

Investors supporting finmid

The funding came from Blossom Capital, Earlybird VC, and N26-founder Max Tayenthal.

Ophelia Brown, Partner at Blossom Capital, says, “You don’t need banks to offer financial services, and in many ways, they aren’t well-positioned or set up to support the next generation of small & medium businesses.”

“Lengthy approval processes, low approval rates, and high fees are some of the challenges businesses face today in dealing with their banks. Yet, offering financial services is a highly profitable business case.”

“We believe every B2B software platform needs to think about how to leverage financial services to serve better and retain their customers, as well as increase their margins to stay competitive in the long term. The most innovative & forward-thinking businesses in Europe are already doing so. And finmid is the best partner they can get to do it successfully.”

Blossom Capital claims to be Europe’s largest Series A fund, focused on founders in consumer internet, cybersecurity, developer tools, enterprise SaaS, and marketplaces. The firm’s notable investments include Checkout.com, Moonpay, Pigment, and Tines.

Earlybird Venture Capital, founded in 1997, invests in European tech startups. It provides financial backing, strategic support, and access to a broad international network and capital markets.

With €2B under management across various funds, including Digital West, Digital East, Health, Earlybird-X, and Growth Opportunities, Earlybird claims to be an active and established venture capital firm in Europe.

Financing solutions for your business customers

Founded in 2021 by Alex Talkanista and Max Schertel, finmid is a financial services infrastructure provider that helps businesses offer financing to their customers at scale.

With an API and dashboard, finmid enables companies to create flexible finance solutions, driving revenue growth and customer retention.

The startup brings personalised banking services back to small and medium businesses by empowering B2B software platforms like Wolt and Safi to offer tailored financial solutions to their customers, such as restaurants and retailers.

Co-founder Schertel, says, “At finmid, our mission is to help every business access the capital it needs. But our approach might surprise you. How do we bring back the relationships that made banking work for so long?”

“With just a few lines of code, finmid enables any B2B software platform to offer financing to its customers, building on existing relationships with restaurants, retailers, and traders to fuel its business growth.”

Co-founder Talkanitsa, adds, “Traditional banking will no longer be the primary source for business financing. Banks still have the largest pool of capital but struggle to deploy it efficiently. It’s time for a new way of banking.”

“We believe B2B software platforms are the future distribution channel for financial services as they have relationships with thousands of businesses. Moreover, these platforms have access to real-time data, enabling streamlined user interactions.”

“By leveraging the extensive reach, data insights, and relationships these platforms maintain, alongside financial capital, we’re looking at a modern way of business financing.”

How finmid works?

finmid offers financing solutions tailored for European SMBs through two key products:

- Capital: Designed for B2B software platforms, this solution grants immediate access to future revenues based on sales history. Implemented with platforms like Wolt, it enables businesses in property and hospitality sectors to receive cash advances on their future earnings.

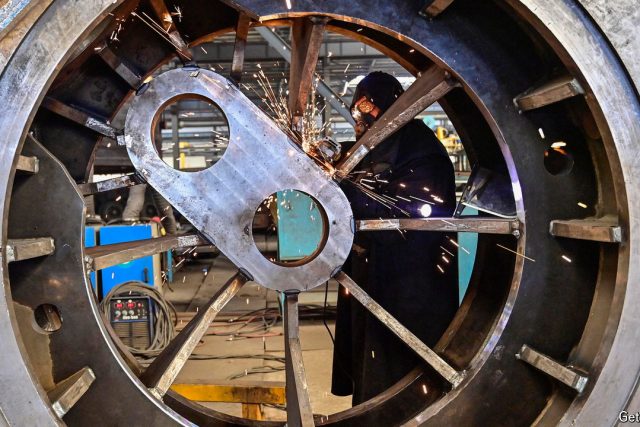

- B2B Payments: Facilitates trading and provides working capital for partners like Frupro (fruits and vegetables marketplace), Safi, Metycle, Romco (recyclables marketplaces), VonWood (timber marketplace), Vanilla Steel (metal marketplace), and more.

finmid’s partnerships

In 2023, Wolt teamed up with finmid to bolster their merchant support by launching ‘Wolt Capital’, a cash advance feature to support their merchants.

Vincent Huang, CPO at Wolt, says, “We’re constantly looking for ways to support our merchant partners and help them succeed. Together with finmid, we’re able to provide easy and flexible access to additional financing – helping our partner develop their businesses or have a safety net during tough times.”

“The feedback we have received has been extremely encouraging, and we’re excited to see what kind of value we can create with the program moving forward.”

Finmid also partnered with Safi, a global recycling marketplace, to address cash flow challenges for recycling facility managers waiting on extended payment terms.

finmid partners with Safi to bridge global buyers and sellers with a flexible B2B Payments solution. This enables recycling facilities to receive early payouts for materials and helps buyers manage cash flow with extended payment terms.

The Most Read

Сryptocurrencies

Bitcoin and Altcoins Trading Near Make-or-Break Levels

Financial crimes

Thieves targeted crypto execs and threatened their families in wide-ranging scheme

Financial crimes

Visa Warning: Hackers Ramp Up Card Stealing Attacks At Gas Stations

News

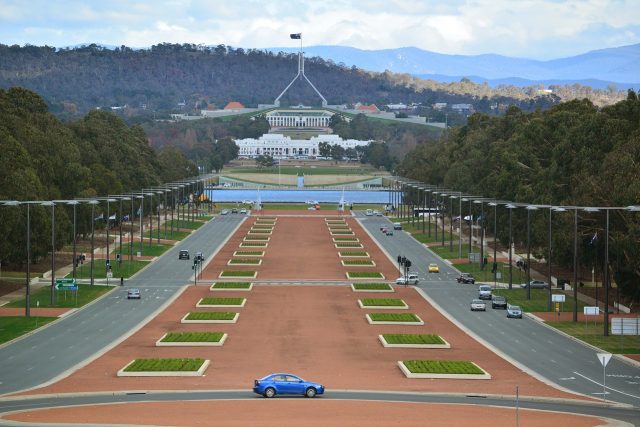

Capitalism is having an identity crisis – but it is still the best system

Uncategorized

The 73-year-old Vietnamese refugee is responsible for bringing Sriracha to American consumers

Uncategorized

Electric Truckmaker Rivian, Backed By Amazon, Ford, Raises Whopping $1.3 Billion