Amsterdam-based bunq, the second largest neobank in Europe, announced on Tuesday, December 19, that it has launched Finn, a GenAI platform at bunq Update 24 in DeLaMar Theater in Amsterdam.

Powered by LLMs, Finn enables bunq users to plan their finances, better budget, navigate the app, easily find transactions, and much more.

“Finn will wow you,” says Ali Niknam, founder and CEO of bunq.

“Years of AI innovation, coupled with a laser focus on our users, allowed us to transform banking as you know it completely. Seeing Generative AI make life so much easier for our users is incredibly exciting,” adds Niknam.

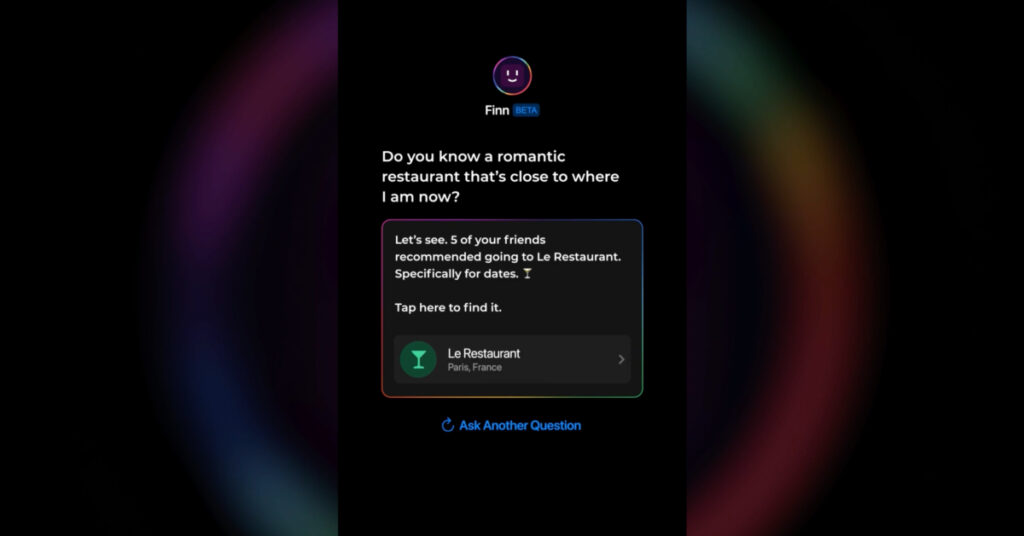

Like ChatGPT, Finn features a chat-style text box where users can ask questions or seek advice about their bank account, spending habits, savings, and anything else related to money.

Based on bunq’s technology, Finn provides answers to various advanced questions like

“What is the average amount I spend on groceries per month?” or “How much did I spend on Amazon this year?”.

It can even combine data to answer questions beyond transactions, such as “What was that Indian place I went to with a friend in London?”, or “How much did I spend at the cafe near Central Park last Saturday?”

Besides Finn’s launch, the Amsterdam neobank also announced that it has hit 11 million users across the EU and grew its user deposits by 55 per cent since July 2023, now at €7B.

bunq’s previous development

A few weeks back, Ali Niknam received the prestigious Businessman of the Year award, recognising his contributions to the business world.

The award was presented on the Master Expo fair’s first day by real estate entrepreneur Cor van Zadelhoff.

In July, the Dutch neobank raised an additional €44.5M in growth funding, bringing the total raised capital to nearly €100M this year.

bunq: Europe’s second-largest neobank

Ali Niknam founded bunq in 2012 after he secured the first European banking permit in over 35 years.

He was the company’s sole investor until 2021, financing the company with €98.7M of his own money.

The neobank claims this allowed it the freedom to build a bank rooted in the wants and needs of its users.

The fintech company was the only self-funded challenger bank that branched into 30 European markets without a penny of VC funds.

The Most Read

Сryptocurrencies

Bitcoin and Altcoins Trading Near Make-or-Break Levels

Financial crimes

Thieves targeted crypto execs and threatened their families in wide-ranging scheme

Financial crimes

Visa Warning: Hackers Ramp Up Card Stealing Attacks At Gas Stations

News

Capitalism is having an identity crisis – but it is still the best system

Uncategorized

The 73-year-old Vietnamese refugee is responsible for bringing Sriracha to American consumers

Uncategorized

Electric Truckmaker Rivian, Backed By Amazon, Ford, Raises Whopping $1.3 Billion