Image credits: Sprinque

Amsterdam-based Sprinque, a flexible payments platform for local and cross-border B2B transactions, announced on Tuesday that it has secured €20M debt facility from Avellinia Capital.

The announcement comes five months after raising €6M in a Seed round of funding led by Connect Ventures.

Sprinque says it will use the funds to support B2B e-commerce merchants who sell Pay-by-Invoice to businesses.

The debt facility will also enable the Dutch company to finance approximately €200M in transactions annually.

The investor

Avellinia Capital is a private credit investment manager providing tailor-made and flexible asset-based financing solutions to fast-growing specialty lenders and specialty finance originators.

In a conversation with Silicon Canals, Mark Holleman, co-founder and CPO of Sprinque, shares his insights on persuading Avellinia Capital.

“We had worked with different lenders before meeting the Avellinia Capital team. When we first met them, Avellinia Capital and Sprinque clicked immediately,” says Holleman.

“We both believe in the potential of the B2B market. The Avellinia Capital team understood that their approach to working with us must be flexible and open-minded, and they loved the Sprinque team,” adds Holleman.

Flexible B2B payment platform

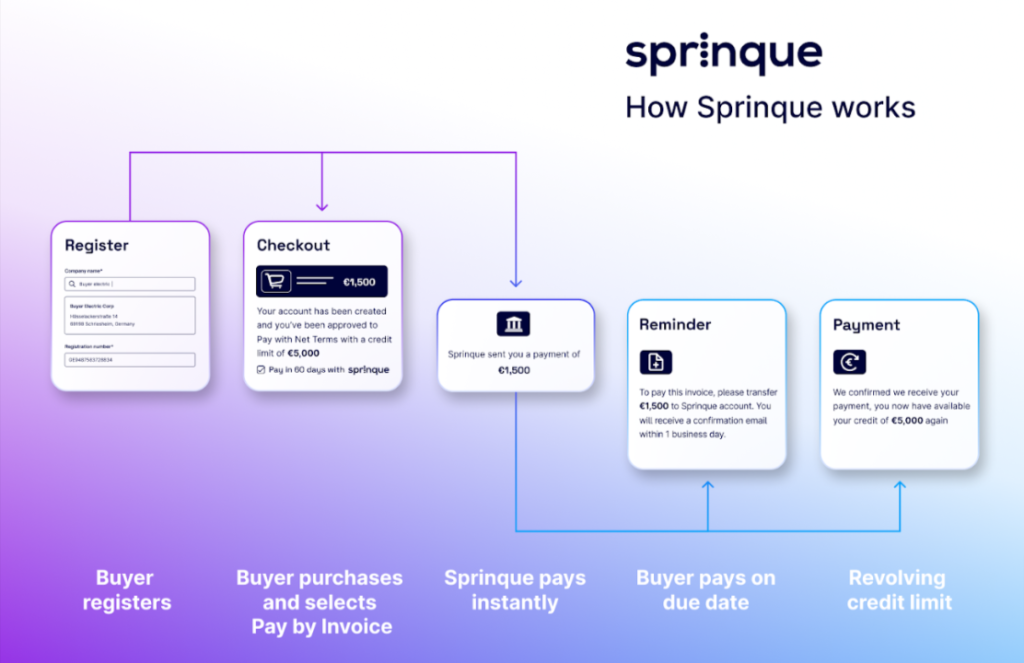

Manoj Tutika (CTO), Mark Holleman (CPO), and Juan Espinosa (CEO) founded Sprinque in February 2021. It enables B2B merchants and B2B marketplaces to extend payment terms to their customers, with the option to pay 15-90 days later without additional risk or operational overhead.

The inspiration for Sprinque came from Holleman’s time building BNPL experiences for Amazon’s marketplaces in Europe. He realised that building such experiences for all of Europe is complex and costly and that B2B is a massively underserved segment when it comes to enabling frictionless transactions, online and offline.

What makes Sprinque stand out?

“Our focus from the start has been on building a pan-European platform that aims to go global. We did not want to build a local solution and stay a local player,” Holleman tells Silicon Canals.

“The real opportunity exists around cross-border transactions, and this is a problem worth solving, to contribute to fulfilling the potential of the borderless European market,” he adds.

Sprinque has merchants in the Netherlands, Belgium, Germany, Sweden, the UK, France, and Spain, with buyers all over Europe and beyond.

He says, “Another differentiator is that our platform was built specifically for B2B purchasing flows, which are often quite different from B2C e-commerce. With our platform and our APIs, we can support any purchasing flow, whether it is real-time decisioning in an online checkout or a gated environment or a quote-to-cash process.”

Fast and friendly buyer purchasing experience

Holleman says the process of applying for Pay-by-Invoice services has not been very accommodating towards businesses, especially when considering time sensitivity.

Sprinque addresses this by verifying businesses and making fraud and credit decisions in seconds.

“We leverage a broad set of data sources, from traditional credit bureaus to alternative data sources, to make these decisions in real time,” adds Holleman.

He further states, “Also, we never reject businesses outright; if for some reason a buyer is not successful in getting a credit limit assigned automatically, they always end up in our manual review process where we take a closer look at the business before making a final decision. As we learn and our risk engine gets smarter, the percentage of businesses ending up in manual review decreases.”

Sprinque also claims to take on all default risks for approved transactions.

Holleman says, “Sprinque takes on all fraud and credit defaults, which means merchants can ‘Sell & Forget’. Once we approve a buyer and an order, from that moment onwards, the merchant does not need to worry about if, when and how they will get paid.”

Developing a pan-European financing network

The Amsterdam company built a dedicated Special Purpose Vehicle (SPV) structure with Collections Foundations for their merchant financing services.

Sprinque claims that this structure is the first building block for a pan-European financing network that will support B2B merchants across all European countries shortly.

“All merchant settlements and all invoice payments from buyers flow via the Collection Foundation (Stichting Sprinque),” says Holleman.

“This means that we can add multiple Special Purpose Vehicles behind Stichting Sprinque, without impacting how we settle to merchants or how buyers pay their invoices. This allows us to easily add SPVs in our structure for new markets or lenders,” he tells Silicon Canals.

Mitigating economic pressures

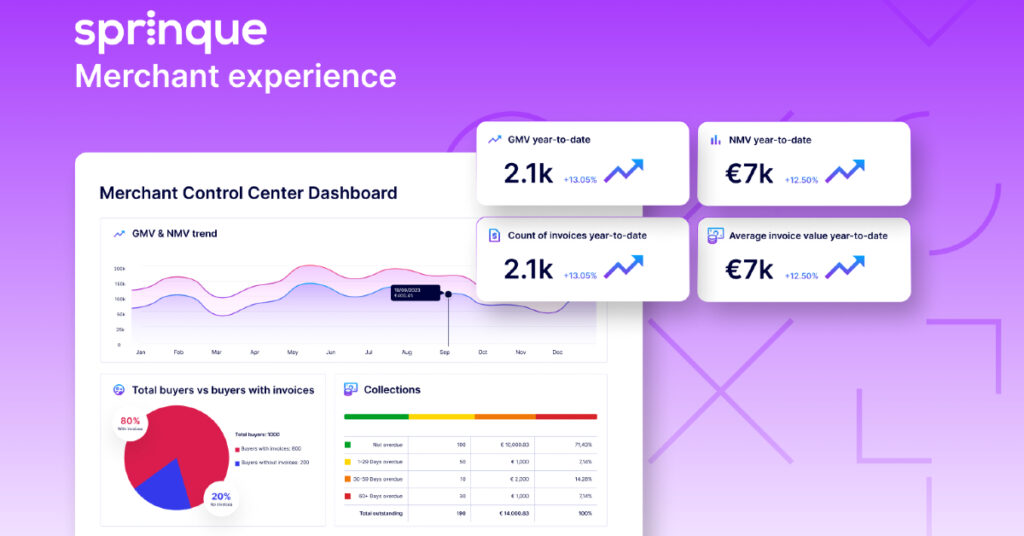

The company’s Pay-by-Invoice solution aims to help businesses mitigate economic pressures through dynamic settlements.

“Merchants can decide exactly when they want to be paid for an order. This helps merchants optimise their working capital needs, while only paying financing costs for the financing they need,” Holleman says.

The debt facility offers more liquidity to current and future B2B merchants who sell on Pay-by-Invoice with net payment terms of 7, 15, 30, 45, 60, or 90 days, as well as alternative options for Pay-in-Instalments.

“With a static settlement framework, merchants will always get paid the same number of days after an order has been placed or an invoice has been issued, regardless of whether they need the financing for that order/invoice, or not. And merchants have to pay for this service, even if they don’t need it,” says Holleman.

Roadmap for 2023

With a current acceptance rate of 90%+, Sprinque aims to keep Pay-by-Invoice systems as frictionless as possible by handling the process from end-to-end on behalf of merchants.

It includes onboarding and verifying the business buyer, setting and managing the credit limit for approved business buyers, settling the transaction with the merchant in their preferred currency, and collecting invoice payment from the business buyer once the invoice falls due.

“The most ambitious upcoming development is our expansion outside of Europe, to help US merchants sell to buyers in Europe. This is a development that will still happen in 2023,” concludes Holleman.

The Most Read

Сryptocurrencies

Bitcoin and Altcoins Trading Near Make-or-Break Levels

Financial crimes

Thieves targeted crypto execs and threatened their families in wide-ranging scheme

Financial crimes

Visa Warning: Hackers Ramp Up Card Stealing Attacks At Gas Stations

News

Capitalism is having an identity crisis – but it is still the best system

Uncategorized

The 73-year-old Vietnamese refugee is responsible for bringing Sriracha to American consumers

Uncategorized

Electric Truckmaker Rivian, Backed By Amazon, Ford, Raises Whopping $1.3 Billion