For america’s commerce secretary, midway through a trip to Beijing, to describe China as “uninvestible” might once have prompted an unpleasant diplomatic spat. Yet when Gina Raimondo did so a month ago, it barely caused a ripple. That was not just because the rest of her visit was a clear attempt at rapprochement. It was also because it is now firmly established that American companies, as well as Western investors more generally, see China in such terms.

The bad news just keeps coming. Sometimes it is Chinese authorities raiding the offices of American companies and detaining their staff, as they did to Mintz Group, a due-diligence firm, earlier this year. At other times it is Chinese bosses disappearing, as has happened on numerous occasions in recent years. In September it emerged that an investment banker at Nomura had been barred from leaving the country. All of this is happening in the context of a profound economic malaise. On October 1st the World Bank became the latest institution to downgrade its gdp forecasts for China. And disturbing the sleep of investors is an even bleaker prospect: a Chinese invasion of Taiwan. Should Xi Jinping decide to launch such a war, the resulting sanctions would cause economic and financial chaos, stranding capital ploughed into Chinese assets.

It is tempting, then, for Western investors to look at these risks and conclude that China is just too troublesome to think about, which is exactly what many are doing. On the face of it, avoiding China should be a reasonably straightforward task. After all, the world’s second-biggest economy does not have a particularly large presence in equity indices. Take, for example, msci’s broadest index of global stocks, ranked according to market value. American shares occupy a weight of 63%. By contrast, Chinese ones manage barely a thirtieth of that, at just 3%.

Yet there is a snag. Investors might easily be able to screen out Chinese stocks. They cannot so easily escape the pull of the world’s second superpower. Therefore even those who cut their exposure to China will have little choice but to keep tabs on the country’s fortunes.

To understand why, begin with China’s role in Western supply chains. Prompted both by covid-era trade snarl-ups and by increasing geopolitical concerns, companies are doing their best to diversify. It is proving heavy going, however. In 2022 Apple produced the majority of its products in China. By 2025, despite concerted efforts to find new countries in which to manufacture, that will still be true.

Less visible, though no less important, is the share of Western firms’ cash flows that come directly from China. Analysts at Morgan Stanley, an investment bank, have studied the revenues of 1,077 North American companies to determine their exposure to foreign markets. Those in the information-technology sector, which comprises more than a quarter of the s&p 500 index, earn 12% of their revenues from China. For semiconductor firms—such as Nvidia, this year’s star performer—the figure is even higher, at 28%. Western sanctions resulting from an invasion of Taiwan might leave investments in Chinese assets stranded. But reciprocal sanctions from China could hobble some American firms, too.

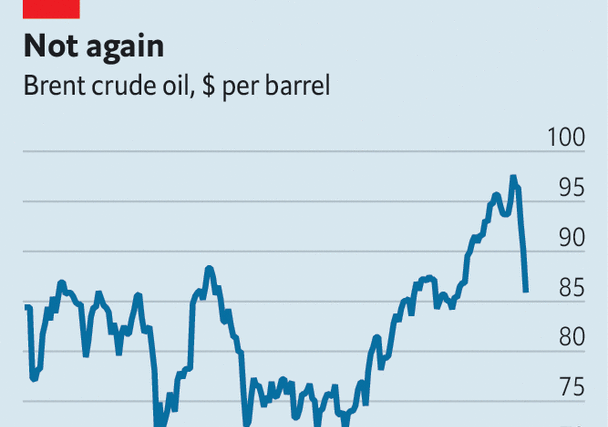

A final line of exposure comes from China’s gargantuan demand for commodities. Analysts at Goldman Sachs, another investment bank, reckon that China accounts for 16% of global demand for oil, 17% for liquefied natural gas, 51% for copper, 55% for steel, 58% for coal and 60% for aluminium. The immediate consequence is that prices for commodities, and the shares of any firm that buys or sells a lot of them, depend heavily on Chinese economic growth, or a lack of it. Given commodities’ impact on broader prices, this also means that if your portfolio is exposed to inflation—or to the swings in interest rates that accompany it—then it is exposed to China.

One way to read all this is as a counsel of despair. The risks of staking money on China’s growth and stability are both palpable and large. It is pretty much impossible to construct a portfolio that will benefit from global growth, which also lacks exposure to China, since anything to do with technology, commodity prices, inflation, interest rates or any country dependent on the world’s second-biggest economy brings with it some risk. The other reading is the same as the time-worn case for buying American assets. It is not that they offer guaranteed returns. It is that if they face disaster, so too will everything else.■

Read more from Buttonwood, our columnist on financial markets:

Investors’ enthusiasm for Japanese stocks has gone overboard (Sep 28th)

How to avoid a common investment mistake (Sep 21)

Why diamonds are losing their allure (Sep 13th)

Also: How the Buttonwood column got its name

The Most Read

Сryptocurrencies

Bitcoin and Altcoins Trading Near Make-or-Break Levels

Financial crimes

Thieves targeted crypto execs and threatened their families in wide-ranging scheme

Financial crimes

Visa Warning: Hackers Ramp Up Card Stealing Attacks At Gas Stations

News

Capitalism is having an identity crisis – but it is still the best system

Uncategorized

The 73-year-old Vietnamese refugee is responsible for bringing Sriracha to American consumers

Uncategorized

Electric Truckmaker Rivian, Backed By Amazon, Ford, Raises Whopping $1.3 Billion