Image credits: SumUp

London-based SumUp, a fintech company, announced on Wednesday that it has entered into a $100M (approximately €91M) credit facility with Victory Park Capital, an alternative investment firm that specialises in private credit.

The credit facility will enable SumUp to provide advance payments to UK merchants. The company also has plans to expand this service to other European markets in the foreseeable future.

SumUp Cash Advance: What to know

SumUp cash advance helps merchants finance their operations and seize business growth opportunities.

According to the UK company, this product has a wide array of applications and potential use cases:

- Upgrade machinery and equipment

- Procure vital inventory in anticipation of busy periods,

- Support transformative renovations to revamp facilities or capitalise on strategic growth prospects.

The cash advance product can also be used to deal with emergencies, such as unforeseen equipment breakdowns, helping to alleviate short-term pressures.

Under the programme, eligible merchants can receive advances of up to £20K based on their historical payment records.

The repayment structure allows merchants to settle their advances flexibly and gradually by

accepting payments through SumUp’s card readers.

Merchants can access cash advances for a transparent and fixed fee without hidden fees or monthly interest.

SumUp: Help businesses accept card payments

SumUp was founded in 2012 by Jan Deepen, Marc-Alexander Christ, Petter Made, and Stefan

Jeschonnek. The company helps businesses accept card payments at the point of sale or on the go.

Since its inception, SumUp says it has become the financial partner for over 4 million small businesses worldwide.

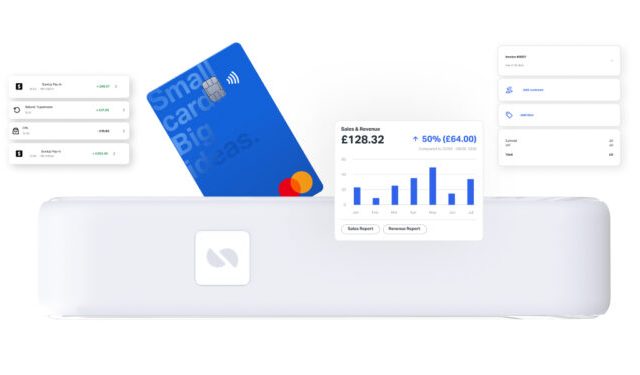

The financial services super app from SumUp helps merchants with a free business account and card, an online store, an invoicing solution, and in-person and remote payments.

SumUp does this by seamlessly integrating these solutions into its proprietary card terminals and point-of-sale registers.

Marc-Alexander Christ says, “Since SumUp launched in 2012, we have witnessed a transformative evolution in merchant needs. In response, we have continually invested in new, sector-leading innovations, from pioneering hardware to cutting-edge software solutions.”

“We are thrilled to partner with Victory Park Capital, further enabling our mission of simplifying business operations for our merchants. Our cash advance product can transparently and fairly support business growth, enabling merchants to continue doing what they do best without worrying about accessing funds. Feedback has been positive to date; merchants appreciate the product’s simplicity, the speed of payout, and its convenient way of paying back the cash advance via card reader sales,” he adds.

The Investor

Victory Park Capital Advisors is an SEC-registered, established credit manager. VPC provides custom financing solutions across the private capital spectrum, focusing on companies with strong corporate governance and a compelling growth trajectory.

VPC invests in emerging and established businesses across various industries worldwide.

Jason Brown, Partner at VPC, says, “We are dedicated to supporting forward-thinking, innovative companies that enable wider access to financing solutions for small businesses. SumUp is a global fintech leader with a data-driven approach and product suite that matches the needs of modern businesses. We are delighted to partner with SumUp as they expand their offering and provide merchants with fair and clear, short-term financing amidst a challenging market climate.”

…your recruitment or product development with our curated community partners!

The Most Read

Сryptocurrencies

Bitcoin and Altcoins Trading Near Make-or-Break Levels

Financial crimes

Thieves targeted crypto execs and threatened their families in wide-ranging scheme

Financial crimes

Visa Warning: Hackers Ramp Up Card Stealing Attacks At Gas Stations

News

Capitalism is having an identity crisis – but it is still the best system

Uncategorized

The 73-year-old Vietnamese refugee is responsible for bringing Sriracha to American consumers

Uncategorized

Electric Truckmaker Rivian, Backed By Amazon, Ford, Raises Whopping $1.3 Billion