More people are paying attention to America’s regional banks than ever before. But it is difficult to work out the state of their balance-sheets. Recent data from the Federal Financial Institutions Examination Council, a regulator, offer a glimpse. Our analysis suggests several regional banks are struggling with flighty deposits, interest-rate mismatches and pricey borrowing. Even if none are about to collapse, the outlook is grim.

Start with deposits. Before the panic in March, savers were moving money to high-yielding money-market funds. The fall of Silicon Valley Bank (svb) sped up the trend. Accounts with balances over the $250,000 federal-insurance limit fell by nearly 5% across the banking system—and by more than 11% at midsized lenders. At PacWest, an institution in California, total deposits dropped by 17% and uninsured ones by more than half.

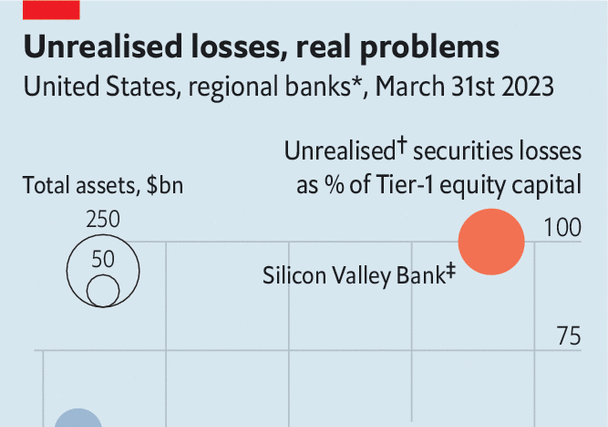

Many banks are still sitting on billions in unrealised losses. The data show that America’s banks in aggregate have more than $500bn in such losses on their securities portfolios. Charles Schwab, a broker that has seen its share price fall by two-fifths this year, holds more than $21bn in paper losses through its banking subsidiaries. When svb collapsed, unrealised losses on its securities amounted to 100% of core equity capital (see chart).

Outstanding borrowing at American banks reached $1.3trn in the most recent quarter, up more than 40% on the previous one. At large institutions, borrowing rose by 26%; at midsized ones, it more than doubled. Schwab reported $39bn of short-term advances from the Federal Home Loan Banks (fhlb), up from $12bn in the previous three months. KeyBank, an Ohio-based lender, borrowed $19bn in short-term fhlb loans, up from $11bn. Such loans come at today’s high interest rates. Banks that rely on them might survive the crisis. But they will probably see their profits suffer.

For more expert analysis of the biggest stories in economics, finance and markets, sign up to Money Talks, our weekly subscriber-only newsletter.

The Most Read

Сryptocurrencies

Bitcoin and Altcoins Trading Near Make-or-Break Levels

Financial crimes

Thieves targeted crypto execs and threatened their families in wide-ranging scheme

Financial crimes

Visa Warning: Hackers Ramp Up Card Stealing Attacks At Gas Stations

News

Capitalism is having an identity crisis – but it is still the best system

Uncategorized

The 73-year-old Vietnamese refugee is responsible for bringing Sriracha to American consumers

Uncategorized

Electric Truckmaker Rivian, Backed By Amazon, Ford, Raises Whopping $1.3 Billion